cotton metallic fabric hs code Fibers and yarns are classified in Chapters 50 through 58 of the Harmonized Tariff Schedule. In order to properly classify them, it is necessary to understand their construction, nomenclature . $49.99

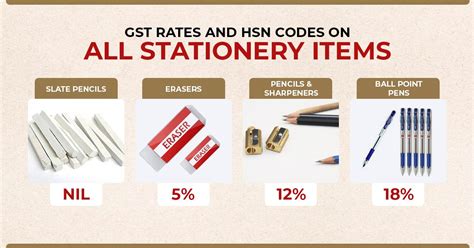

0 · hsn code 5208 gst rate

1 · fabric hsn code list

2 · fabric hsn code 6 digit

3 · cotton printed fabric hsn code

4 · cotton hsn code 8 digit

5 · 5208 hsn code 6 digit

6 · 100% cotton fabric hsn code

7 · 100 cotton fabric hs code

Male conduit connector with 1/2inch trade size conduit opening for connecting Wiremold 500/700 Series raceway to conduit boxes or panel boxes that have KOs for conduit. Can also be used .

Metallised yarn, whether or not gimped, being textile yarn, or strip or the like of heading 5404 or 5405, of textile fibres, combined with metal in .Fibers and yarns are classified in Chapters 50 through 58 of the Harmonized Tariff Schedule. In order to properly classify them, it is necessary to understand their construction, nomenclature .The Harmonized Tariff Schedule of the United States (HTS) sets out the tariff rates and statistical categories for all merchandise imported into the United States. The HTS is based on the .Use our free HS & HTS code lookup tool to find the tariff code for your products. Simply search using your product’s name, description, or code. If you need further assistance, our customs .

US Hs Tariff Code of Chapter-52 Cotton and Combed Cotton waste, yarn waste, Cotton sewing thread. Woven fabrics of cotton, man-made fibres and woven fabrics.

cotton fabric HS-codes.com is specialize in providing harmonized tariff numbers and commodity codes. Visit us online to get the various hs codes and commodity description.textile fabric cotton HS-codes.com is specialize in providing harmonized tariff numbers and commodity codes. Visit us online to get the various hs codes and commodity description.

Woven fabrics of cotton, containing less than 85|% by weight of cotton, mixed mainly or solely with man-made fibres, weighing more than 200|g/mWoven fabrics of cotton, containing predominantly, but < 85% cotton by weight, mixed principally or solely with man-made fibres and weighing > 200 g/m², unbleached (excl. those in three .Metallised yarn, whether or not gimped, being textile yarn, or strip or the like of heading 5404 or 5405, of textile fibres, combined with metal in .Fibers and yarns are classified in Chapters 50 through 58 of the Harmonized Tariff Schedule. In order to properly classify them, it is necessary to understand their construction, nomenclature and terminology.

hsn code 5208 gst rate

The Harmonized Tariff Schedule of the United States (HTS) sets out the tariff rates and statistical categories for all merchandise imported into the United States. The HTS is based on the international Harmonized System, which is the global system of nomenclature applied to most world trade in goods.Use our free HS & HTS code lookup tool to find the tariff code for your products. Simply search using your product’s name, description, or code. If you need further assistance, our customs experts are here to help. The fabric import tariff ranges from 0-20%, as revealed by the Harmonized Tariff Schedule (HTS). You can therefore expect the cost of some fabrics to be low and that of others to be relatively high. Factors Influencing Textile Import Duty Rates

US Hs Tariff Code of Chapter-52 Cotton and Combed Cotton waste, yarn waste, Cotton sewing thread. Woven fabrics of cotton, man-made fibres and woven fabrics.cotton fabric HS-codes.com is specialize in providing harmonized tariff numbers and commodity codes. Visit us online to get the various hs codes and commodity description.textile fabric cotton HS-codes.com is specialize in providing harmonized tariff numbers and commodity codes. Visit us online to get the various hs codes and commodity description.Woven fabrics of cotton, containing less than 85|% by weight of cotton, mixed mainly or solely with man-made fibres, weighing more than 200|g/m

Woven fabrics of cotton, containing predominantly, but < 85% cotton by weight, mixed principally or solely with man-made fibres and weighing > 200 g/m², unbleached (excl. those in three-thread or four-thread twill, incl. cross twill, and plain woven fabrics) Can be .

Metallised yarn, whether or not gimped, being textile yarn, or strip or the like of heading 5404 or 5405, of textile fibres, combined with metal in .

Fibers and yarns are classified in Chapters 50 through 58 of the Harmonized Tariff Schedule. In order to properly classify them, it is necessary to understand their construction, nomenclature and terminology.The Harmonized Tariff Schedule of the United States (HTS) sets out the tariff rates and statistical categories for all merchandise imported into the United States. The HTS is based on the international Harmonized System, which is the global system of nomenclature applied to most world trade in goods.

metal gift boxes for flowers

Use our free HS & HTS code lookup tool to find the tariff code for your products. Simply search using your product’s name, description, or code. If you need further assistance, our customs experts are here to help. The fabric import tariff ranges from 0-20%, as revealed by the Harmonized Tariff Schedule (HTS). You can therefore expect the cost of some fabrics to be low and that of others to be relatively high. Factors Influencing Textile Import Duty RatesUS Hs Tariff Code of Chapter-52 Cotton and Combed Cotton waste, yarn waste, Cotton sewing thread. Woven fabrics of cotton, man-made fibres and woven fabrics.

metal grommet for fabric

cotton fabric HS-codes.com is specialize in providing harmonized tariff numbers and commodity codes. Visit us online to get the various hs codes and commodity description.textile fabric cotton HS-codes.com is specialize in providing harmonized tariff numbers and commodity codes. Visit us online to get the various hs codes and commodity description.Woven fabrics of cotton, containing less than 85|% by weight of cotton, mixed mainly or solely with man-made fibres, weighing more than 200|g/m

fabric hsn code list

fabric hsn code 6 digit

Discover the perfect window box for your home at www.windowbox.com. Explore our extensive collection featuring wrought iron, fiberglass, PVC, vinyl, and more. Enhance your curb appeal with our diverse hardware, self-watering options, and railing choices.

cotton metallic fabric hs code|5208 hsn code 6 digit