1099-r box 14 state distribution has an amount We would like to show you a description here but the site won’t allow us. $72.62

0 · state distribution on my form

1 · irs non periodic distribution form

2 · intuit box 1099 r

3 · form 1099 r pdf

4 · box 1099 r box 16

5 · 1099 r state distribution blank

6 · 1099 r state distribution

7 · 1099 r box 16 blank

$3.66

state distribution on my form

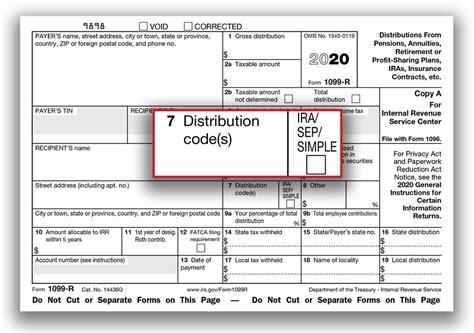

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution.

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT .TurboTax is here to make the tax filing process as easy as possible. We're .Find TurboTax help articles, Community discussions with other TurboTax users, .

gray house black metal roof

irs non periodic distribution form

We would like to show you a description here but the site won’t allow us.

@Tpaoli70 1099-R box 14 is state tax withheld. Box 15 is the state and ID. Box 16 is the distribution amount. If you are a full year resident, you can use your box 2a amount in . If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early . You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This amount should include the following: For redeemed United States savings bonds, Box 1 will contain the .

Boxes 14 – 19 show state and local tax withholdings as well as the part of the distribution reported to the state. Note that certain retirement payments or distributions a taxpayer receives from a retirement plan or IRA can be .

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is . A 1099-R tax form reports distributions from a retirement plan — income you might have to pay federal income tax on. But the form isn’t just for retirees drawing on their nest eggs. There are other situations when you might . When there in only one state listed in box 13, then it is understood that the state distribution is the *same* as the federal distribution, so financial institutions just leave box 14 .

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution. @Tpaoli70 1099-R box 14 is state tax withheld. Box 15 is the state and ID. Box 16 is the distribution amount. If you are a full year resident, you can use your box 2a amount in box 16. Are you saying you are online and don't see the state boxes for 14-16 in the program? Maybe you have stuck information, try: If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .

granite precision machining manufacturer

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This amount should include the following: For redeemed United States savings bonds, Box 1 will contain the value of bonds distributed from a plan. The taxable amount of redeemed bonds should appear in Box 2a.

Boxes 14 – 19 show state and local tax withholdings as well as the part of the distribution reported to the state. Note that certain retirement payments or distributions a taxpayer receives from a retirement plan or IRA can be “rolled over” by depositing the payment into another retirement plan or IRA within 60 days of the date of . 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable. A 1099-R tax form reports distributions from a retirement plan — income you might have to pay federal income tax on. But the form isn’t just for retirees drawing on their nest eggs. There are other situations when you might get a 1099-R before you retire. When there in only one state listed in box 13, then it is understood that the state distribution is the *same* as the federal distribution, so financial institutions just leave box 14 blank because a blank box 14 means the same at the box 1 amount.

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution. @Tpaoli70 1099-R box 14 is state tax withheld. Box 15 is the state and ID. Box 16 is the distribution amount. If you are a full year resident, you can use your box 2a amount in box 16. Are you saying you are online and don't see the state boxes for 14-16 in the program? Maybe you have stuck information, try:

If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

You should find the total amount of pension benefits or account distribution in Box 1, before tax withholdings. This amount should include the following: For redeemed United States savings bonds, Box 1 will contain the value of bonds distributed from a plan. The taxable amount of redeemed bonds should appear in Box 2a. Boxes 14 – 19 show state and local tax withholdings as well as the part of the distribution reported to the state. Note that certain retirement payments or distributions a taxpayer receives from a retirement plan or IRA can be “rolled over” by depositing the payment into another retirement plan or IRA within 60 days of the date of . 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable. A 1099-R tax form reports distributions from a retirement plan — income you might have to pay federal income tax on. But the form isn’t just for retirees drawing on their nest eggs. There are other situations when you might get a 1099-R before you retire.

intuit box 1099 r

The Winsor & Newton Artists' Professional Water Colour Lightweight Metal Box 24 Half Pan Set is the ultimate choice at amazing value. This set offers a well-balanced array of 24 Artist quality Half Pans, brilliant and pure colours ready at the touch of a brush.With 115 colours, our Professional Watercolour range offers bright, vibrant colours and unrivalled performance. Watercolour, more than any other medium, reflects the unique characteristics of .

1099-r box 14 state distribution has an amount|1099 r state distribution blank