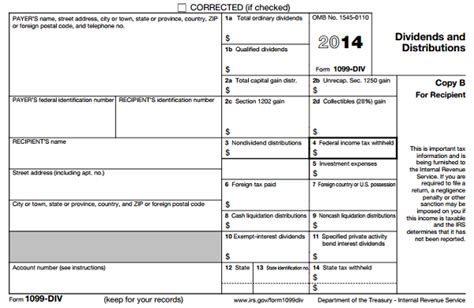

box 2a total capital gain distribution The profit paid out is a capital gain distribution. This also applies to pay outs made by crediting your cash account. For tax purposes, Form 1099-DIV , Box 2a reports your capital-gain . Yankee Sheet Metal Inc is located at 35 Wrobel Pl in East Hartford, Connecticut 06108. Yankee Sheet Metal Inc can be contacted via phone at 860-528-9431 for pricing, hours and directions. Contact Info

0 · form 1099 div box 2a

1 · form 1099 div box 12

2 · capital gain distributions tax treatment

3 · box 2a 1099 div

4 · box 12 exempt interest dividends

5 · are capital gains distributions taxable

6 · 1099 div box 12 states

7 · 1099 div 2a explained

Unlock endless creativity with the first machine that combines laser, inkjet blade cutting and even printing, turning ideas into reality effortlessly.

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.Consider capital gain distributions as long-term capital gains no matter how long .

The profit paid out is a capital gain distribution. This also applies to pay outs made by crediting your cash account. For tax purposes, Form 1099-DIV , Box 2a reports your capital-gain . Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities . Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), .Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form .

The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13. The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and .

Box 2a Total capital gain distributions - These are distributions from a regulated investment company (RIC) or a real estate investment trust (REIT). This amount is reported on Schedule D (Form 1040) and it includes the amounts that are .If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Box 1b reports the portion of box 1a that is considered to be qualified dividends. If your investment makes a reportable capital gain distribution to you, it will be reported in box 2a.The profit paid out is a capital gain distribution. This also applies to pay outs made by crediting your cash account. For tax purposes, Form 1099-DIV , Box 2a reports your capital-gain distributions.

Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay . Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses.

Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040). But, if no amount is shown in boxes 2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13. The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares.

Box 2a Total capital gain distributions - These are distributions from a regulated investment company (RIC) or a real estate investment trust (REIT). This amount is reported on Schedule D (Form 1040) and it includes the amounts that are also reported in Boxes 2b, 2c, and 2d.If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Box 1b reports the portion of box 1a that is considered to be qualified dividends. If your investment makes a reportable capital gain distribution to you, it will be reported in box 2a.

36v electric motor gear box for kids ride on

The profit paid out is a capital gain distribution. This also applies to pay outs made by crediting your cash account. For tax purposes, Form 1099-DIV , Box 2a reports your capital-gain distributions.

form 1099 div box 2a

Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay .

Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), Capital Gains and Losses.Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or real estate investment trust (REIT). See How To Report in the Instructions for Schedule D (Form 1040). But, if no amount is shown in boxes 2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13.

3d cnc milling machine price

The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for . Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares.

form 1099 div box 12

Buy the Southwire X-Treme Box Portable Power Distribution Center from EquipSupply. Provides safe all-weather event and work-site power distribution.

box 2a total capital gain distribution|are capital gains distributions taxable